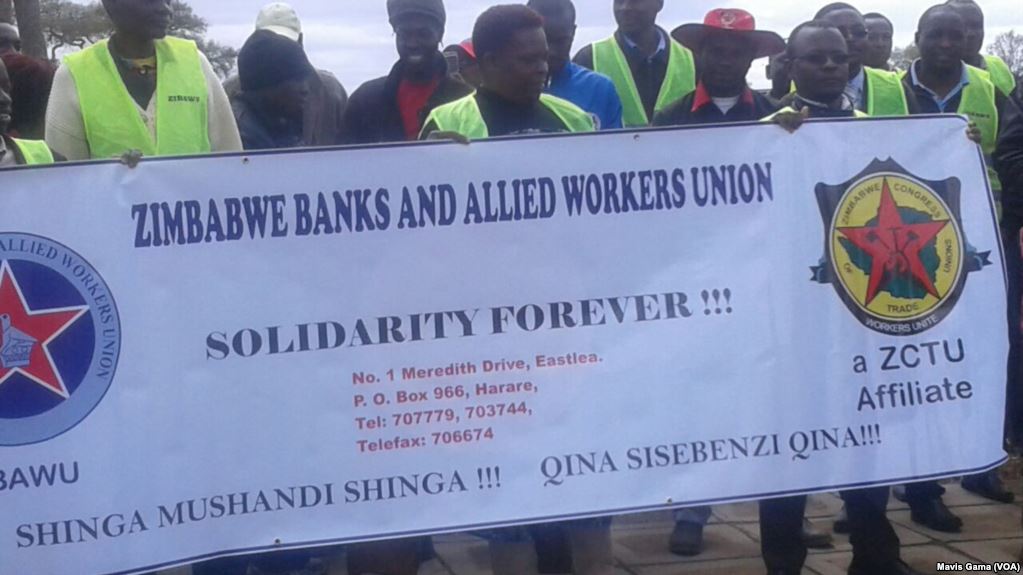

Employees in the financial and banking sector under the Zimbabwe Banks and Allied Workers Union (Zibawu) have accused banks of ripping-off clients while paying them slave wages.

The workers, in a letter addressed to the officer commanding Harare province undersigned by the union's Tirivanhu Marimo, say they will stage demonstrations on June 13 to pressure the Reserve Bank of Zimbabwe (RBZ) into action and sanction the Bankers Employers Association of Zimbabwe BEAZ into reviewing their salaries upwards.

"This is a precursor to our planned collective job action against (BEAZ). We have disagreed on salary increases in the banking sector and are currently finalising all processes necessary for workers to embark on collective job action.

"Our action is informed by the fact that banks are making huge profits at the expense of workers and customers. In fact we believe banks are literally stealing from customers. Therefore the central theme of our action will be that either banks pay well or they must reduce bank charges so that the prices of goods and services also fall for the good of all, including workers," read the statement.

Zimbabwe is currently faced with unprecedented cash shortages that have resulted in most people sleeping in queues only to withdraw small amounts that are charged by the banks.

In 2016, Zimbabwe introduced "bond notes" which were meant to be on par with the US dollar, but have since managed to lose comparative value.

Currently, for every US$100 bill, Zimbabweans pay $127 in bond notes or $145 in Zimbabwe's electronic currency known as "Zollars", an arrangement which has come to be known as the three-tier pricing system.

The liquidity situation has escalated to such an extent that ATMs are empty and banks only allow customers to withdraw $20 in bond notes a day.

This means people have become unproductive wasting their days away queuing in front of banks.

The impact of the currency shortage has not been limited to everyday consumers but has also affected financial institutions workers who were generally regarded as well-heeled.

Most people have lost faith in the banking sector and the union said its leaders will petition Reserve Bank of Zimbabwe (RBZ) governor John Mangudya to pressure him into action.

"We hope in light of the pronouncement of the new dispensation by the head of State (President Emmerson Mnangagwa), our constitutional right to peacefully demonstrate will be respected by all," Marimo said in the letter.

According to the letter at least 500 bank workers will demonstrate on the day to pile pressure on the RBZ to reform the banking sector and also as warning shots to their employers.

Last month after reaching a deadlock with their employers (Baz), which had offered a 3,4 percent increment, the workers said the offer was an insult considering that since 2011 banks had increased service charges and made profits.

The memo pointed out that employers had to choose between increasing wages sufficiently to align with market realities or reduce their bank charges by 30 to 40 percent.

- dailynews

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick