Zimbabwean banks have been ranked among the worst financial institutions in the world due to low capitalisation levels and systemic risks inherent in the economy.

According to the World Economic Forum (WEF)'s global competitiveness 2013 to 14 report released recently, the country was ranked 137 out of 148 countries on soundness of its banks.

The southern African nation was also ranked 140 in terms of venture capital availability.

WEF's global competitive index also revealed that affordable financial services remain elusive to the majority of Zimbabweans as the country scored 3,2 points out of seven and was ranked 134 out of 148 countries.

"...despite efforts to improve its macroeconomic environment - including the dollarisation of its economy, which brought down inflation and interest rates - Zimbabwe still receives a low rank… demonstrating the extent of efforts still needed to ensure its macroeconomic stability," the WEF report said.

It added: "Weaknesses in other areas include health (132nd in the health sub-pillar), low education enrolment rates, and formal markets that continue to function with difficulty (particularly with regard to goods and labour markets, ranked 130th and 140th, respectively)."

This comes as the country has been facing an acute liquidity crisis since adoption of the multi-currency system in 2009, a challenge which has been compounded by the lack of the Reserve Bank of Zimbabwe (RBZ)'s capacity as lender of last resort.

Zimbabwe currently has 26 banks, 16 asset management companies and 172 microfinance institutions under the supervision of the Reserve Bank.

However, due to poor corporate governance and risk management systems and inadequate capitalisation, two banks - Interfin Banking Corporation and Genesis Investment Bank - closed shop in 2012.

Prompted by the need to protect depositors' funds, the central bank last year raised capital requirements for banks tenfold.

RBZ governor Gideon Gono said the increase in minimum capital levels for banking institutions was necessitated by the dynamic nature of the financial landscape, regulatory requirements, increase in competition and economic uncertainties, which placed an unprecedented pressure on banks to be adequately capitalised.

"A fragmented banking system characterised by numerous weak and undercapitalised banks will not only increase the vulnerability of the financial system but also of the economy as a whole," he said then.

Gono noted that the new capital requirements would strengthen both local and international banks so that they play a meaningful role in the development of the economy.

Under the new system, commercial and merchant banks are required to have minimum capital of $100 million from $12,5 million and $10 million respectively.

Minimum capital requirements for building societies were also raised from $10 million to $80 million, finance and discount houses from $7,5 million to $60 million and $1 million to $5 million for micro-finance institutions.

These should be fully compliant by June 2014.

Economic experts say the country's poor credit rating - which has also deteriorated due to huge external debt - has destroyed international financiers' confidence in the nation.

Foreign direct investment as well as other forms of offshore capital, has not been adequate as the nation lost its appeal as a safe investment destination.

- daily news

Concern over Masvingo black market

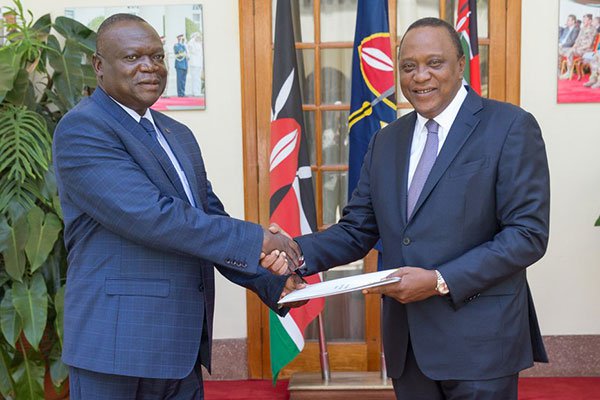

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick