Anglo American has appointed of Mark Cutifani as Chief Executive, with effect from 3 April 2013.

Mark Cutifani has been Chief Executive Officer of AngloGold Ashanti Limited, the South Africa-based gold producer, since 2007 and has led the successful restructuring and development of its business, which includes operations in ten countries on four continents.

Prior to his current role, Mr Cutifani was the Chief Operating Officer of CVRD Inco, the Canadian nickel company. He started his career in the coal and gold mining industries in Australia and has experience across a wide range of commodities. He has a degree in Mining Engineering and is the current President of the South African Chamber of Mines.

Commenting on Mr Cutifani's appointment, Anglo American's Chairman, Sir John Parker, said: "Mark Cutifani is an experienced listed company chief executive with a focus on creating value. He is a seasoned miner, with broad experience of mining operations and projects across a wide range of commodities and geographies, including South Africa and the Americas. Mark is a highly respected leader in the global mining industry, with values strongly aligned to those of Anglo American. We look forward to welcoming him as our Chief Executive."

Mark Cutifani said of his appointment: "Anglo American has some of the highest quality mining operations and projects amongst its diversified peer group, bound together within a company with a deep sense of responsibility. I am delighted to have the opportunity to lead Anglo American at this important stage in its journey, to unlock the company's very considerable value potential."

Anglo American's current Chief Executive, Cynthia Carroll, will step down from the Board at the Company's Annual General Meeting in April 2013 and will leave Anglo American at the end of that month.

Paying tribute to Cynthia's leadership, Sir John said: "Cynthia Carroll is an inspirational leader who has had a transformational impact on Anglo American. Among many other things, her legacy will include a step change improvement in safety, sustainability and the quality of our engagement with stakeholders. She will be leaving Anglo American with our thanks for everything she has achieved and with our best wishes for the future."

Remuneration arrangements - Mark Cutifani

Mark Cutifani's remuneration package will comprise a basic salary and variable incentive arrangements which are entirely in line with Anglo American's current remuneration policy and practice.

The key elements of the package are as follows:

- Basic salary - £1,200,000 per annum.

- Bonus Share Plan (BSP) - Mr Cutifani will have the opportunity to participate in Anglo American's annual incentive arrangements (the BSP) for 2013.

Cash element - Maximum award: 87.5% of basic salary.

Share element - Maximum award: 87.5% of basic salary, with a holding period of three years. (Shares are awarded with a value equal to the cash element achieved).

Enhancement Shares - Maximum award: 75% of Bonus Shares (65.6% of basic salary). Awards vest subject to real EPS growth targets over a three year performance period.

- Long Term Incentive Plan (LTIP) - Mr Cutifani will be eligible for an annual award under the Long-Term Incentive Plan of 350% of basic salary. Awards are granted at the discretion of the Remuneration Committee and vest after three years, to the extent that stretching performance conditions have been satisfied.

- Compensation for incentives forfeited - Mr Cutifani will receive an award of restricted shares to compensate him for the loss of incentives from his previous employer.

In order to enhance alignment with the interests of Anglo American shareholders, the Remuneration Committee has taken the decision to utilise Anglo American shares, rather than cash, as the medium for compensation. In addition the Committee has decided that, so far as possible, the compensatory awards should be on a comparable basis to the foregone awards. As such, the Company commissioned a third-party valuation to determine the extent to which the performance conditions were, at the date of assessment, likely to be achieved.

The restricted shares will vest over the next three years, in line with the vesting schedule of the incentives foregone. They will be subject to clawback in the event of Mr Cutifani leaving the Company (except as a Good Leaver) or in the circumstances in which the Company's standard clawback provisions are triggered.

Based on the current AngloGold Ashanti (AGA) share price and current exchange rates, the total value of the compensatory award is c. £2.38m; this figure will be updated at the time of Mr Cutifani's joining Anglo American, based on the average share price and exchange rates over the week prior to that event.

In addition, Mr Cutifani will receive an award of Anglo American restricted shares in lieu of shares foregone under the AGA 2013 Bonus Share Plan award (which is based on performance during 2012). These shares will be deferred for three years in the normal way and will be subject to the normal leaver conditions.

- Shareholding requirements - Mr Cutifani will be required to accumulate a shareholding in Anglo American to the value of two times' basic salary within five years of his appointment.

- Pension - Anglo American will make an annual contribution of 30% of basic salary in respect of Mr Cutifani's pension provision which may be invested into the Company's pension arrangements or taken as a cash allowance.

- Notice Period - The notice period in Mr Cutifani's service contract will be 12 months for either party save that, should the Company serve notice before the first anniversary of his appointment, it will be 18 months.

The remuneration arrangements described above will be set out in the 2012 Directors' Remuneration Report.

The Remuneration Committee will finalise and disclose Cynthia Carroll's leaving arrangements in due course.

- Byo24News

Concern over Masvingo black market

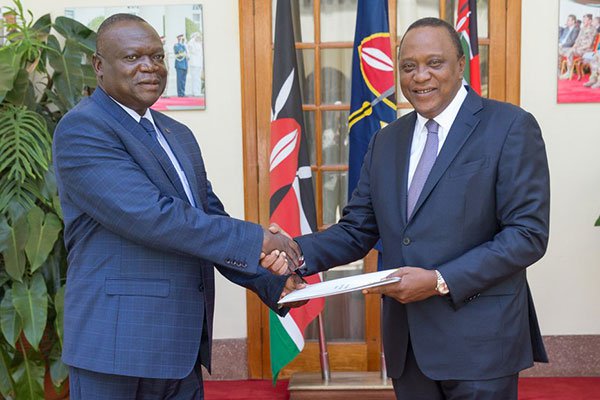

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick